ChOPEX Consolidation As Bulls Retest Highs

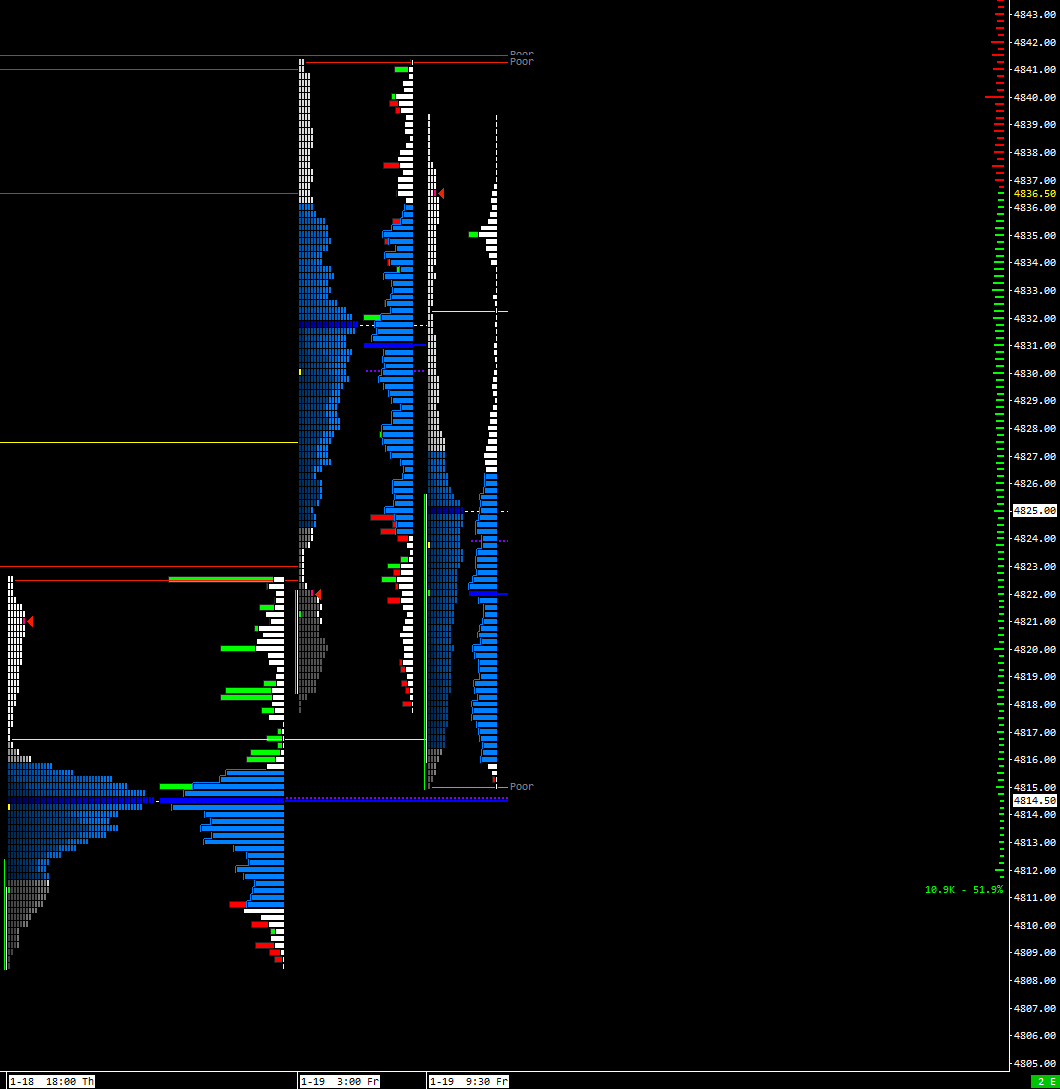

Today's Edge Levels (/ESH4): 4702*, 4746, 4770, 4809, 4817, 4841*

MGI is available within the first 30 minutes of most trading days HERE.

It’s National Popcorn Day, so please tell a trading friend about this newsletter if you’re watching for a move to new highs with kernels in-hand…

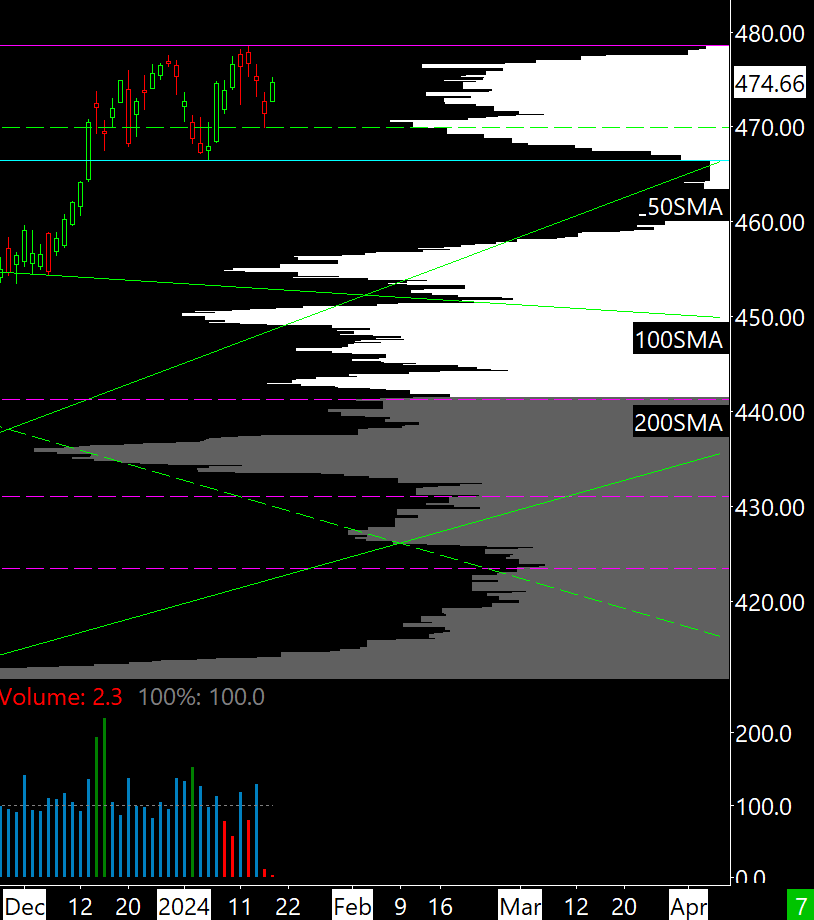

We’ve spent two trading weeks tracking a nice Inverse Head and Shoulders pattern. The below pattern encompasses most of December and January and bespeaks1 the power of Price/Volume confluence.

The importance of the SPY 0.00%↑ 470 level became evident somewhere around December 15. This was when a High Volume Node appeared in the area.

This was long before the pattern began to form. In fact, it was the multiple defenses of this level that created it. Now the question is: does Price finally Breakout or reject again?

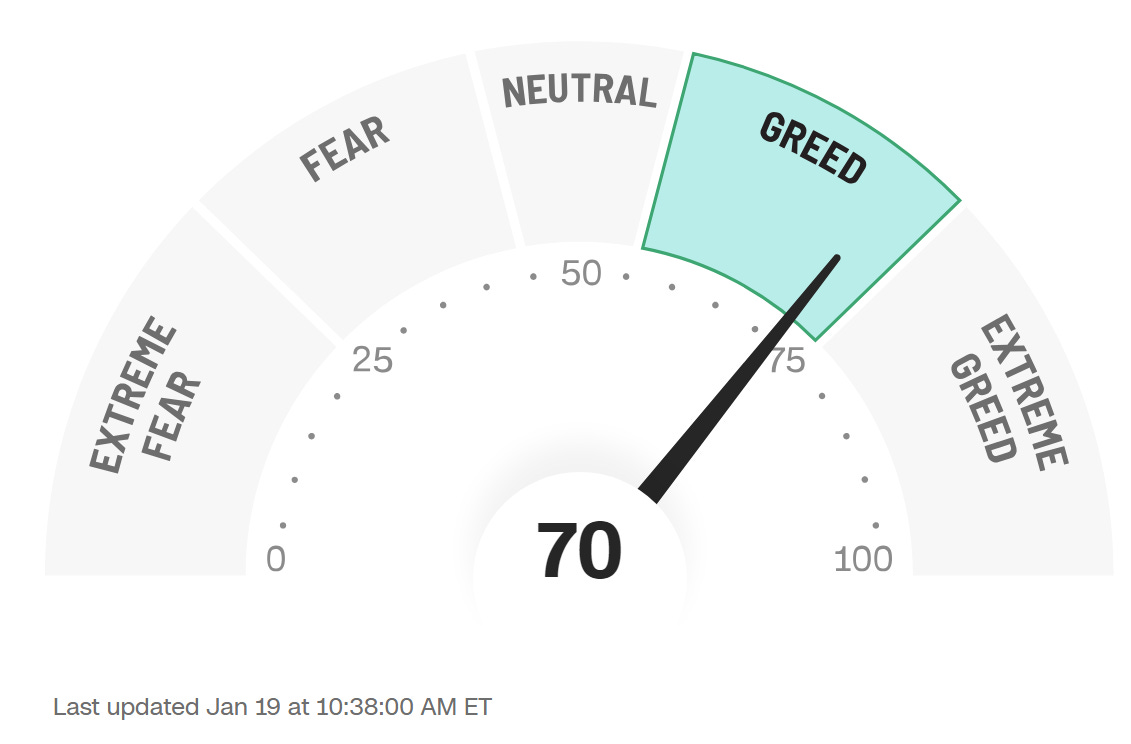

There is a 73 percent chance that SPY 0.00%↑ will close GREEN today.

Structure

My short-term trend assumption remains “neutral-bullish” as long as Price is above 470. No notable developments in Price, Volume, or Volatility in the past 24 hours.

Intraday, the “Line of Least Resistance” is up.

OPEX is notoriously choppy, yet buyers managed to hold an Open-Test-Drive at the edge of the Expected Move. Price is now back near the highs.

Yesterday, I pinned Balance near 4785. This held until the late afternoon squeeze and Balance is now at ~4820, unless bulls extend to new highs. Fade anything above 4840 and you're whacking a rocket with a pickleball racket. Sure, you may catch the high, yet watch out if you don’t!

Because SPY 0.00%↑ itself is in a state of long-term Imbalance, Price will continue to look for new Balance near Naked POCs (nPOC). Above, there are none, which creates a magnet at the highs. Below, the nearest nPOC is now 4825. Below this is 4814.50.

The short-term trend is up above 470. Acceptance below this level will likely bring 466.50, beyond which bears can Breakout lower. The mid-term trend begins to favor sellers below 466.50.

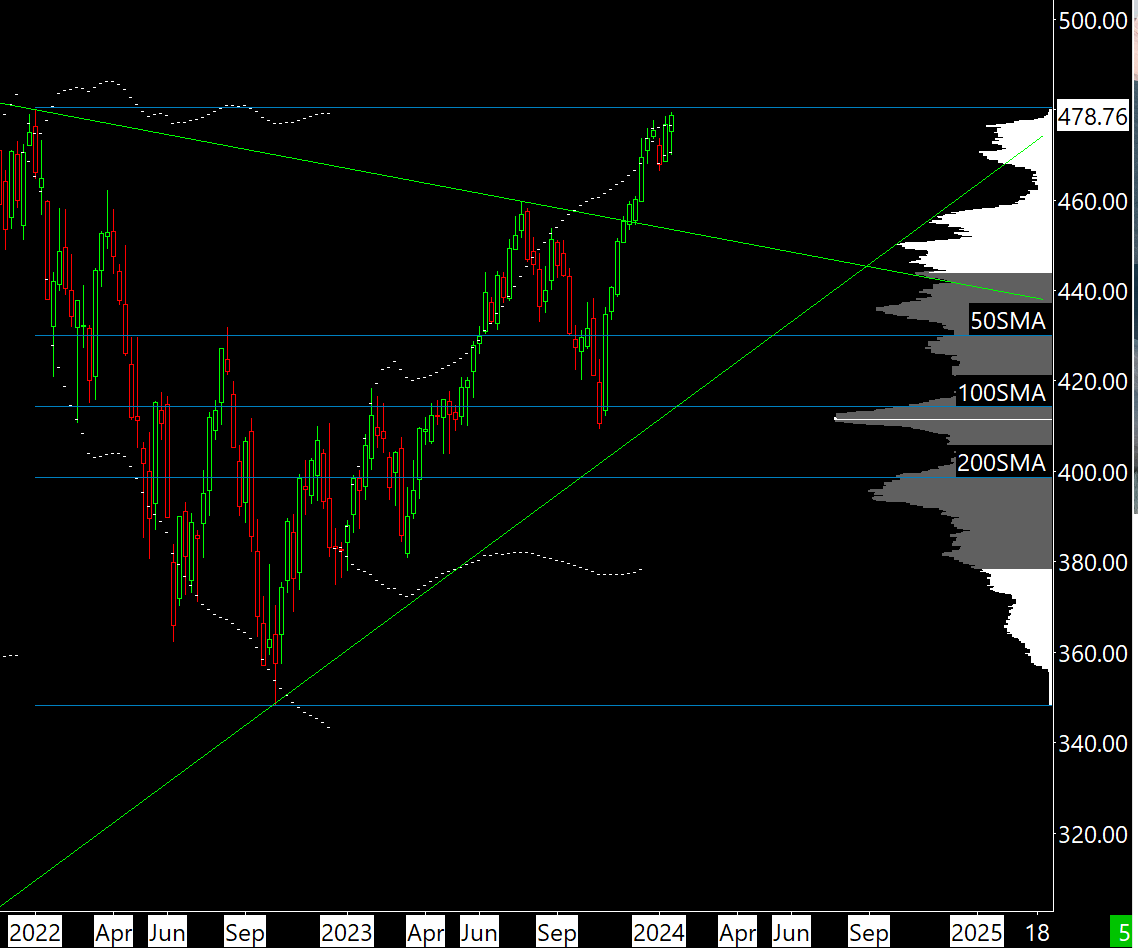

I’ve also included a Weekly chart below. This underscores the long-term bullish trend as Price hovers near the highest point in human history.

Execution

These resources inform my trading philosophy:

Where I traded: No trades yesterday or today.

Why I traded or didn’t: Mechanics described HERE.

What I did well: Avoided emotional slippage, because no trade.

How I can improve: Strayed a bit from my habit checklist recently. Getting back on track this weekend.

My trading window expired at 11:00 EST, so nothing for me until next week. Grateful for a solid week, and hopeful for more success on Monday!

Thank you for your attention. Embrace every inch. Talk soon.

You can access breaking updates and analyses here.

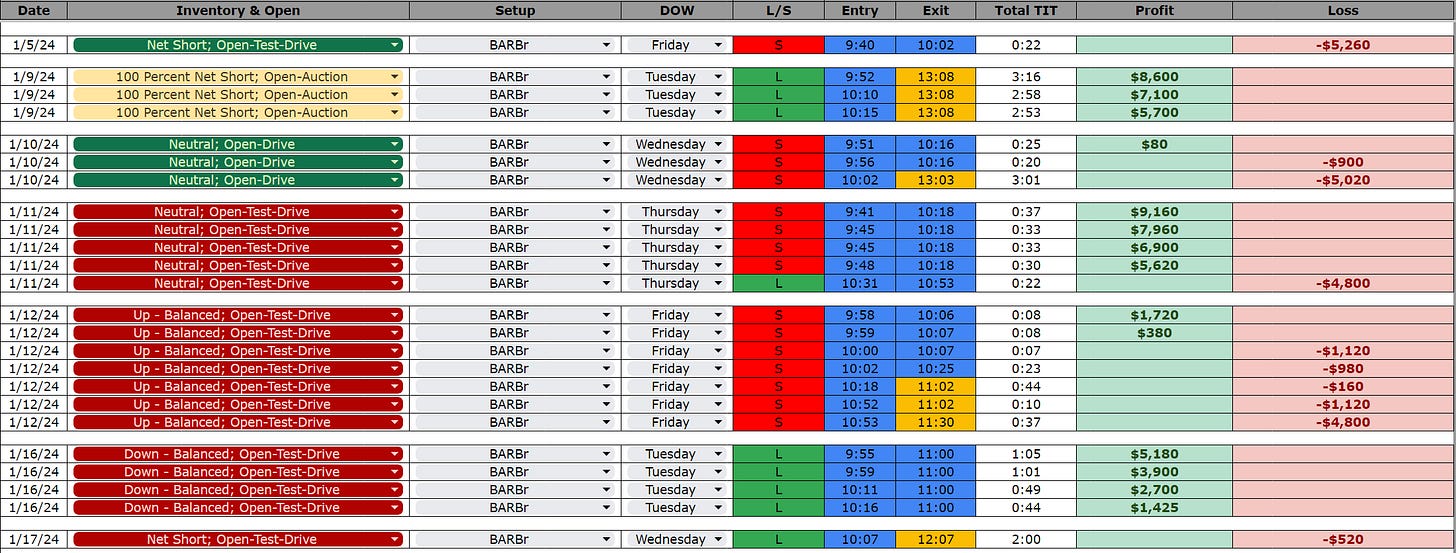

You can view the progression of my daytrade log here (bottom tab).

Mechanics for all my day trading strategies are available here.

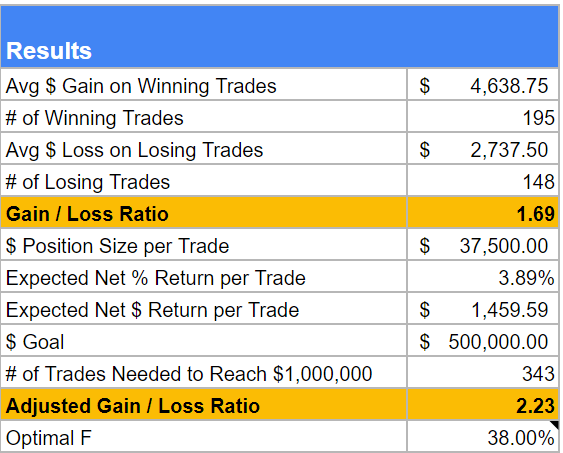

My futures daytrading strategy is optimized for Apex Trader Funding. It’s one of the great opportunities of our time. I’d really appreciate you using my affiliate link (HERE) if you join me on the journey.

You can message me about Apex or with any other inquiries on Twitter or by simply responding to this email.

Would love to connect!

LEGEND’s word of the day. Means “acts as evidence.”