Biggest OPEX In History Following Six Straight Green Days

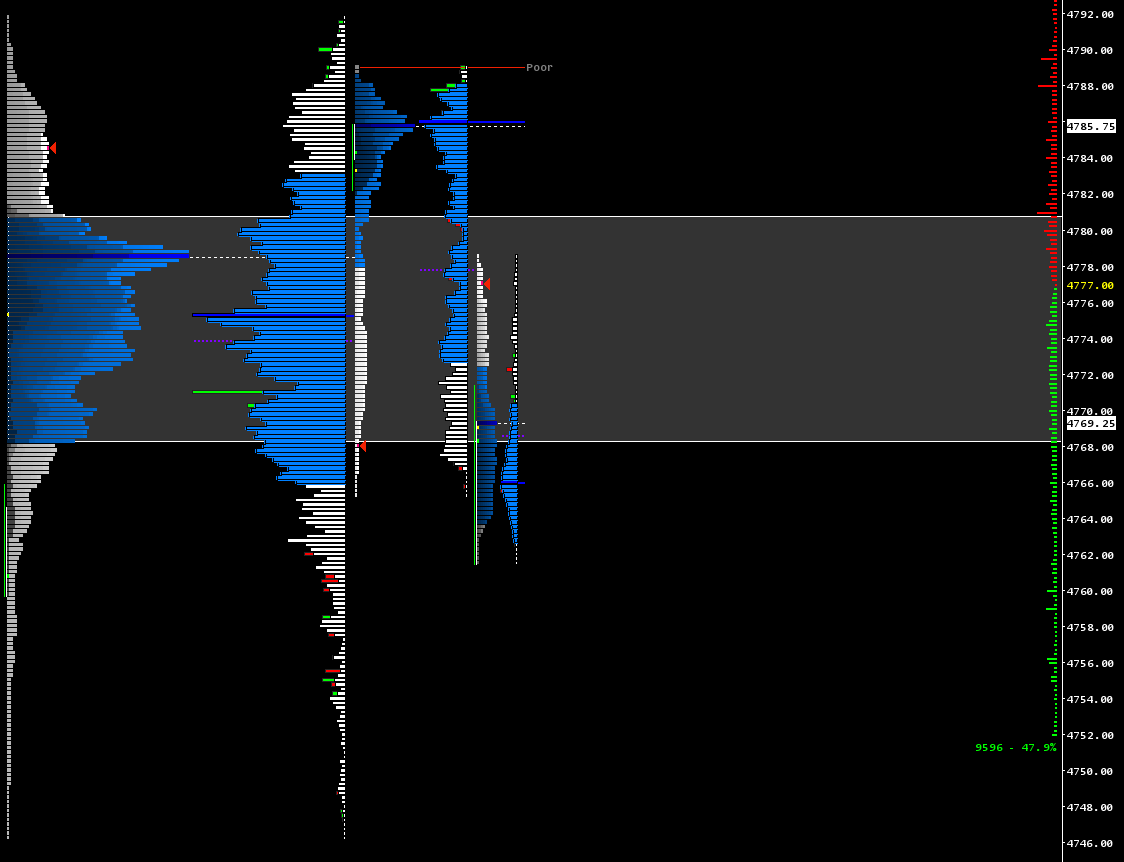

Today's key levels (/ESH4): 4710, 4720-25, 4740-45, 4755, 4765, 4775-80, 4792, 4805

MGI is available within the first 30 minutes of most trading days HERE.

Starting to sound like a broken record here…

So Wednesday happened.

As if the Bears hadn’t suffered enough, the squeeze even qualified for EXTREMELY RARE outlier status.

As I said in Wednesday’s newsletter, “I do not trade FOMC days,” yet this one was a beauty in terms of being a perfect Breakout trade.

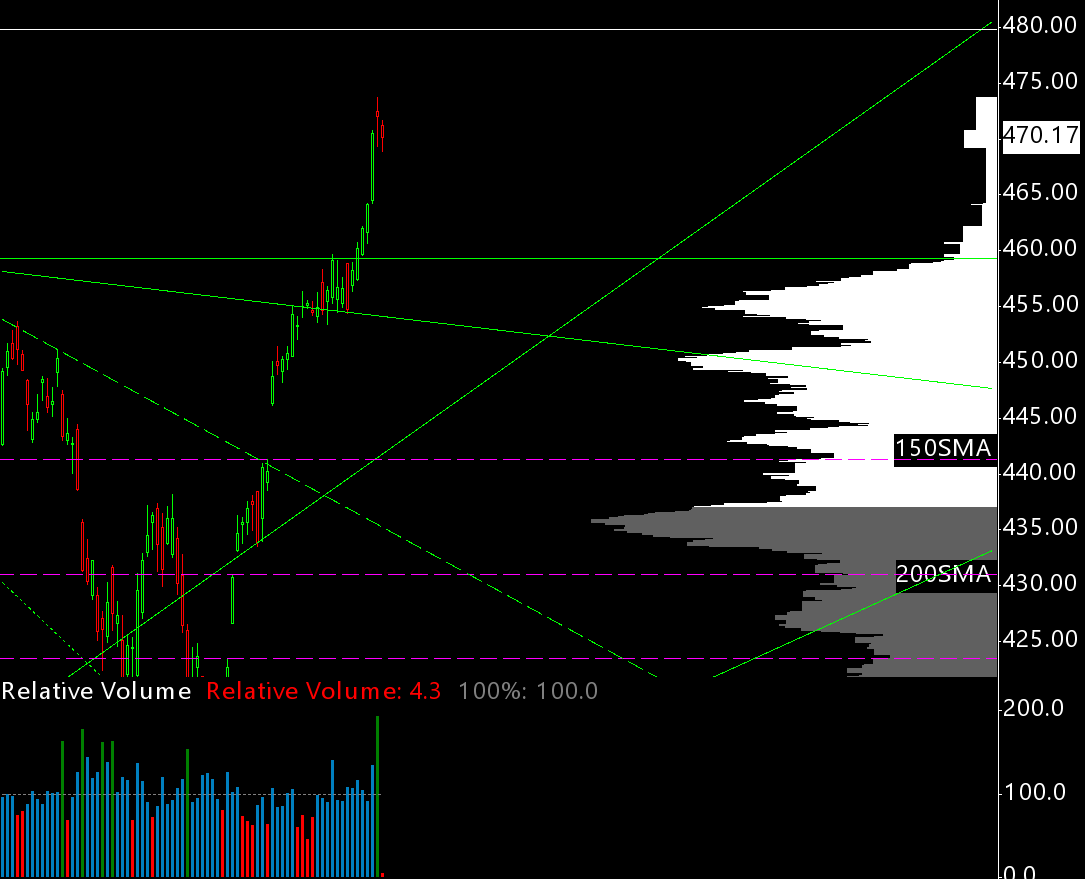

This insane rally has now recaptured almost 650 points with a maximum high to low pullback of ~50 points. Dividend-adjusted SPY 0.00%↑ is beyond its former lifetime high and volatility is dead.

I’d like to conclude this section today with the following tweet:

Line of Least Resistance

My big picture trend assumption remains bullish until we see falling Price accompanied by rising volume and volatility. This confirmation will appear on the Daily chart of SPY 0.00%↑. This doesn’t mean shorts are off the table, just that longs offer higher probabilities.

Bears must now recapture the SPY 0.00%↑ July high of 459.50 and more importantly the key trendline near the 452 level. There is no case for sustained selling whatsoever until this happens.

As you can see in the Volume Profile below, Mr. Market is in a state of Euphoric Imbalance. The Value Area High is all the way down at 436.

I included the massive volume spike accompanying a red candle from yesterday’s SPY 0.00%↑ chart . If we now also see a spike in volatility paired with falling Price, a high probability short is on the table. It’s an unequivocal bull market above the 452 trend line, yet there is still plenty of room for correction in Price.

Discussion

Where I traded: ONL trap again to end the week. This trade got to 75 percent size before the conclusion of trading hours, and 2/3 tranches hit the trailing stop just a moment ago. More on how the final tranche goes Monday.

Why I traded it: Mechanics described HERE.

What I did well: Zero hesitation.

How I can improve: I’ve been buying the bid and selling the ask, yet am often not getting filled instantaneously. Time to take Larry Livingston’s advice and go back to market orders.

Plan For Today

Bulls won today’s Open-Auction (so far) and have retraced to the center of Weekly Balance, ~4780.

Because SPY 0.00%↑ itself is in a state of macro Imbalance, Price will continue to seek a Naked POC to call home. On the upside, the closest level is ~4785. Below, there is open air until ~4700.

OPEX is notorious for poor trading conditions and pinning a certain strike, so I’ll be grateful to end the day green.

Thank you for your attention. Talk soon.

You can access breaking updates and analyses here.

You can view the progression of my new trade log here (bottom tab).

Mechanics for all my day trading strategies are available here.

My futures daytrading strategy is optimized for Apex Trader Funding. It’s one of the great opportunities of our time. I’d really appreciate you using my affiliate link (HERE) if you join me on the journey.

You can message me about Apex or with any other inquiries on Twitter or by simply responding to this email.

Would love to connect!