👋🏼 Hey, it’s Mastro.

Thank you for reading my newsletter, highlighting local trading opportunities in /ESH5.

To stay updated on all Edge Levels and insights, bookmark my MGI document by clicking HERE. 🔖

For Power Hour briefings, follow me on Twitter by clicking HERE.

To view daily live P/L updates, subscribe to my YouTube channel HERE.

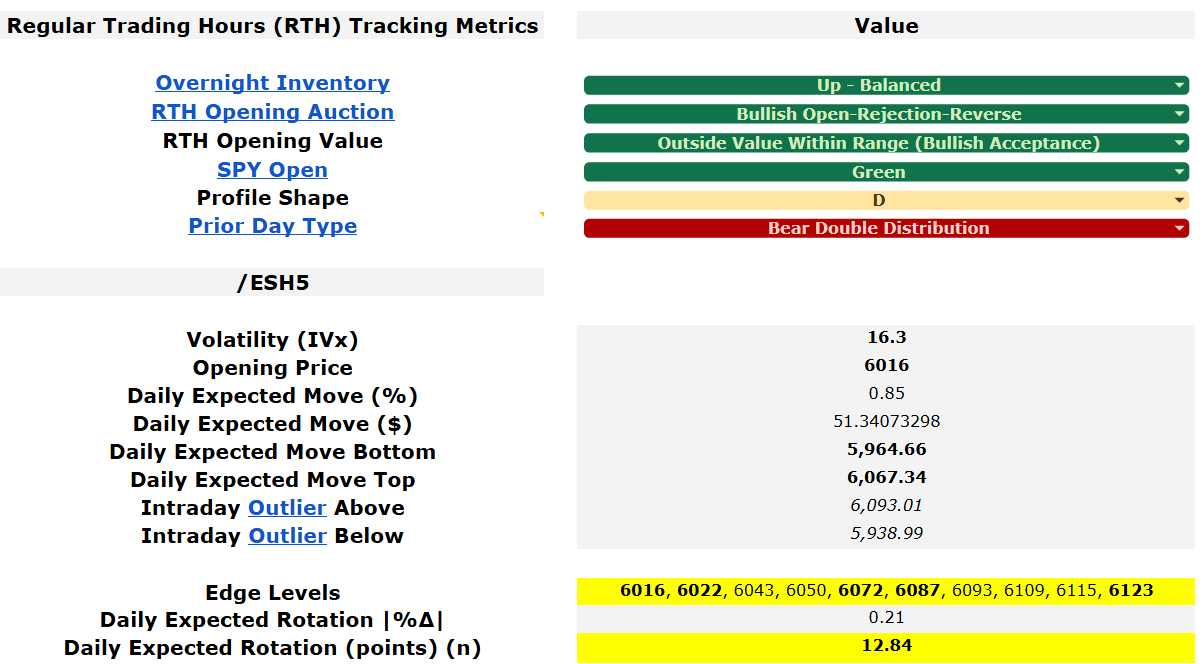

Today, I’ll share my positioning and Power Hour prep for Feb. 10, 2025.

🕧 In less than five minutes of read time.

*~ IMPORTANT ANNOUNCEMENT~*

Apex Trader Funding is running another good sale until Feb. 20.

All details are in the Promo Zone section.

Superb risk: reward, no matter how you look at it.

"It is by going down into the abyss that we recover the treasures of life. Where you stumble, there lies your treasure.”

Remember:

Buying below Balance is expected, responsive order flow. Buying above Balance is unexpected, initiative order flow.

Selling above Balance is expected, responsive order flow. Selling below Balance is unexpected, initiative order flow.

The more time and volume you see at the edge of a Balance, the more likely Price is to seek a new Balance.

Once outside a Balance, Price often retests the old Balance’s extreme before seeking a new Balance. The center of the new Balance is usually a VPOC.

Once Price Accepts into a new Balance, it will likely test the other side (if there isn’t a strong reaction at the POC).

Price inside a Balance usually chops between Value Area extremes.

News is almost always an excuse for the market to do what it was already going to do.

Stats to watch

If SPY 0.00%↑ opens UP, there’s a 73 percent chance it closes GREEN.

If SPY 0.00%↑ opens DOWN, there’s a 67 percent chance it closes RED.

My data suggests a more than 85 percent chance 2025 closes GREEN.

*~Investor sentiment is at a bearish high.~*

February is the worst NASDAQ month in post-presidential election years.

The seventh week of February (this week) has a cluster of bullish seasonality. Monday and Friday close green about 62 percent of the time. Thursday closes green about 72 percent of the time.

Commentary

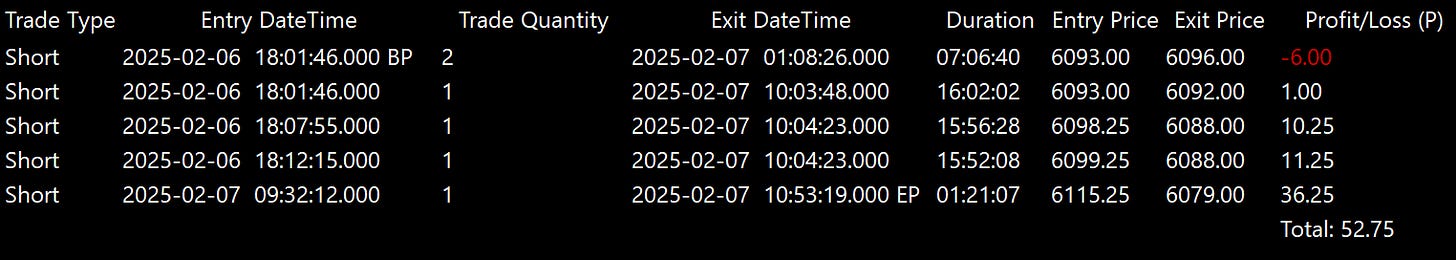

Trading recap from Feb. 7, 2025

Below, I outline one of Friday’s potential entries following bearish DEVISE clearance at about 1:30 p.m.:

Divergence:

The Cumulative Volume Delta (CVD) diverged (relative to 11:20 a.m.), making a lower high as Price made a higher high.

(I prefer “hidden” divergences when the Price makes a higher high and CVD makes a lower high.)

Still, regular divergence qualifies.

Exhaustion:

Aggressive buying occurred as Price pierced 6072 (SPX 6050) at about 1:05 p.m.

This burst of volume and delta disrupted seller absorption.

Volume then tapered, and Price spent about 30 minutes trying to follow through.

Buyers were unsuccessful.

Volume:

Sellers continued to step down to sell the bid, then reload the ask, until deploying aggression at about 1:35 p.m.

The delta gradient, widening candles (acceleration of price velocity), and a Four-Bar Fractal confirmed a potential reversal.

Initiation:

Price made a lower low, rejecting 6072 by 0.25n, demonstrating strong momentum.

Sponge:

Absorption occurs when Price pauses in an area of high liquidity and volume.

In this case, a bearish Sponge occurred at a key supply level.

Despite a high concentration of buyer delta (aggression), sellers reinforced the offer.

This suggested Price was uninterested in further upside exploration.

The Sponge was also visible as a tight cluster of candles.

Excess:

Wicks confirmed potential excess.

However, due to Price’s location mid-profile, I omit this micro-excess as part of yesterday’s DEVISE clearance.

Current Assumption

Which direction is the market attempting to move, and how effective are its attempts?

What “could have,” “should have,” happened, but didn’t?

Macrostructure

In short, nothing has happened. We’re still chopping around SPX 6050.

Three assertions I made in Friday’s newsletter:

Sellers control the field below 6072.

The next downside magnet is 6025, with Acceptance below being bearish.

I’ll be looking for a breakout above 6123.

Sunday opened in the 6025 demand zone, where buyers were waiting.

This made a lot of sense, given the “b” structure I discussed, which implied a lot of passive buyer support.

These passive orders then activated immediately, leading to today’s low-volume squeeze.

Yet, again, nothing has happened.

The macrostructure still has the potential to confirm Three Falling Peaks.

And an equal amount of potential to confirm the opposite (above 6123).

For this reason, I’m entirely flat here for the first time in many months.

We are at the literal center of a multi-month Balance.

So, I want most of my powder dry for the inevitable big move.

Microstructure

It was a Balance Day, so same drill as Friday in /ESH5:

Sellers control the field below 6072.

The next downside magnet is 6025.

I will add SHORT delta if Price reclaims 6025 and LONG if it exceeds 6123.

One note, though:

Supreme Commander Apple closed below 228!

Let’s watch how AAPL 0.00%↑ (and TSLA 0.00%↑ ) develop tomorrow…

Below, I’ve outlined price boxes for my top ten critical stocks and ETFs. These currently imply the market is in a long-term consolidation regime:

AAPL 0.00%↑ : 228 to 234 (BELOW)

AMZN 0.00%↑ : 208 to 236 (WITHIN)

AVGO 0.00%↑ : 196 to 250 (WITHIN)

GOOGL 0.00%↑ : 176 to 193 (WITHIN)

IWM 0.00%↑ : 220 to 230 (WITHIN)

META 0.00%↑ : 675 to 700 (ABOVE)

NVDA 0.00%↑ : 100 to 142 (WITHIN)

QQQ 0.00%↑ : 500 to 528 (ABOVE)

SPY 0.00%↑ : 599 to 610 (WITHIN)

TSLA 0.00%↑ : 350 to 400 (NEAR BOTTOM)

Conclusion

As always, I’ll stick with the routine and try to take the trade with the best DEVISE clearance.

If you can match me, you’re on track to equal or exceed Warren Buffett’s 19.8 percent annualized returns.

Don’t believe it? Do the math for yourself 👇🏼

LEGEND’s word of the day

Flotsam: the wreckage of a ship or its cargo found floating on or washed up by the sea

Promo Zone

I’d love to see you on the livestream trading floor.

Subscribe HERE to get notified when we’re live.

No camera?

No microphone?

No sound?

No problem!

You can hop in the chat.

Until then,

Our gentlemen’s agreement:

I give you free, valuable content.

You use coupon code “MASTRO” when buying any new Apex Trader Funding accounts.

You try to exceed the profits of my top affiliate, who achieved almost seven figures in payouts…

Apex is running another great sale until Feb. 20:

80 percent off all Evals (first month and recurring).

Half-priced resets.

Pass in one day.

$125 LIFETIME PA fees.

Click below to take advantage of the opportunity 👇🏼

My top goal is to give readers a roadmap to consistent payouts:

No matter where you trade, this newsletter aims to help you become a profitable futures scalper.

So remember to bookmark the document linked HERE for easy access to daily Edge Levels and other insights.

Comments?

Questions?

Go ahead and click this button to let me know:

I welcome and appreciate your feedback.

And I thank you for your attention.

Talk soon,

Mastro

PS: I’ll reply to any email you send within 24 hours. You can also click the button below.

I’d love to connect!